Never Too Old For Dad Lessons

Never Too Old For Dad Lessons

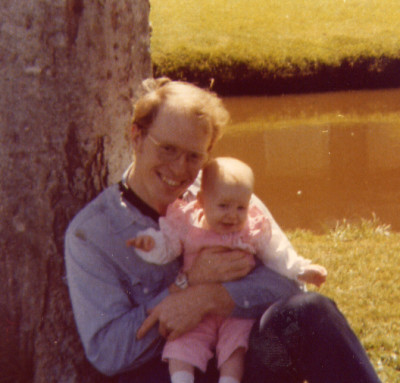

I have said this on the blog before, and actually shared it with my dad on our upcoming podcast, but I never received a financial education from my parents. Interestingly, my dad recently shared that he didn’t feel like I needed to know about money.It’s amazing that my dad didn’t think I needed an education in money where as a parent; teaching financial literacy to my son is high on my priorities. I’m not sure if it’s a change in times or the fact that I’m a financial planner, but I feel as though financial literacy is something every parent is responsible to teach their kids, especially since money impacts all of us and they unfortunately will not receive that education in school.Despite the fact that my dad didn’t teach me about money growing up, he has definitely made up for lost time. I realize that I have learned more about money from my dad in the last five years of my life than I did in the first 32.

Here are some recent money lessons I have learned from my dad:

1) Financial Freedom + Kids is Possible

A few months back I went out to dinner with my dad and discovered that at almost 60 years old (he is now 60) my dad and stepmom could claim financial freedom officially. My dad loves to work and will continue to do so, but he declared over dinner that it feels so much better going to work knowing that you don’t have to work. I have to say that I never thought I would see my dad get to this point so early and that’s because he has four kids, he paid for private high schools (and some private middle schools), four colleges and three out of four weddings thus far. One time when I was sitting at work I calculated how much this financial commitment would cost and it was a staggering figure. When I asked my dad if he knew, he said it wasn’t something he thought about. He wanted to provide a good education for his kids and there wasn’t a price tag for that gift.Anyone who says financial freedom before retirement isn’t possible is just not working hard to get there. My dad and stepmom made big lifestyle changes to reach this goal and they worked together to get there. It wasn’t always easy for them to say no to various activities and indulgences, but they stayed committed to their goal and they are now enjoying the fruits of their efforts despite the financial obligations they fulfilled for four kids.

2) A New Car Is Overrated

My dad has never had the nicest car on the block, and it’s something that never bothered him. He and my stepmom have been driving the same cars for over 8 years and have no interest in trading them in. They were smart, though, in the brands of cars they invested. Both of them drive quality cars and despite paying more upfront for the cars (one was new and one was used), they have made up for it in the length of time they have driven the cars since the investment.I used to think that I needed a nice new car all the time and now I realize that the nicer and newer the car, the further I get behind my goal of financial freedom.

3) Only Eat Out What You Can’t Make At Home

My dad and stepmom are big fans of eating from home, despite the fact that they could afford to eat out as much as the want. They have learned to cook meals that they enjoy and for my dad cooking is almost a therapy after a long day at work. The only times they eat out are for meals that they can’t make at home, and I think this is a great philosophy.We have personally challenged ourselves to cook more from home and try to replicate meals we would eat out at home; and we have found that we not only save money and calories, but we really enjoy the challenge. Before we think about going out to eat now, we literally ask ourselves if we can make it at home.

4) Focus on What’s Important

My dad is a surgeon and it’s easy to get caught up in lifestyle inflation as your paycheck grows, but thankfully he and my stepmom sat down years ago and decided that an education for the kids and financial freedom were two important goals to have. Since that sit down, all of their money choices were easy. With their goals in place, they didn’t worry about new cars, new clothes or expensive dinners. They adjusted their lifestyle around what was important rather than around my dad’s growing paycheck.Two years ago my hubby and I went through a similar exercise of determining what’s important and like my dad, education for our child and financial freedom are it for us. Since we made this connection, our lifestyle choices have fallen into place accordingly and we don’t miss the spendy ways of our past.

5) Bigger Isn’t Better

My dad has lived in the same home for over 20 years and while it’s a beautiful home, it’s certainly not the biggest on the block and they could have upgraded to something bigger along the way. However, a number of years back my dad and stepmom paid off the mortgage on the home and decided that living mortgage free was more important than a bigger home.They have friends with bigger and flashier homes and I think that they are secretly thankful that they not only avoided the mortgage but the monthly upkeep of a larger home.I used to think I wanted to live in a large home, but now that I realized it’s not on my important list, I really don’t care how big my residence is. I would rather see more money in my bank account than more square footage in my home.